Related video published on YouTube.

Translation companies, translators or any other participant in a translation project might find that they have to issue credit notes. Most of the time, credit notes are associated with quality complaints, but many other reasons might prompt a client to ask for one.

In this article, I will briefly go through the information this type of document contains, explore the reasons why credit notes are requested and explain how to avoid them.

1. What is a credit note?

A credit note is a document produced by a subcontractor stating that a certain amount has to be credited to the client. This amount can equal a previously issued invoice, part of an invoice or even the sum of several invoices. It will be repaid to the client or deducted from future payments by the latter.

2. What information is compulsory on a credit note?

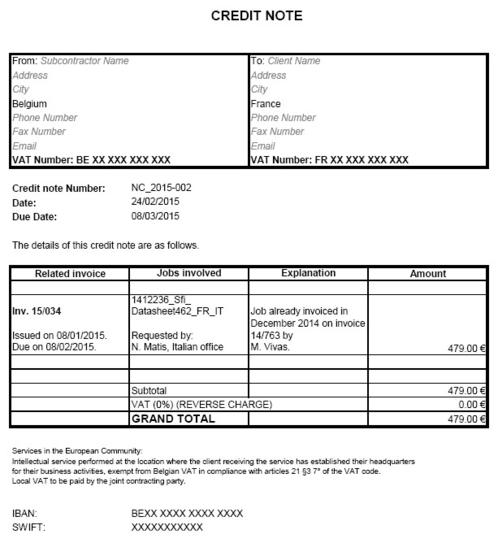

The content of a credit note is very similar to that of an invoice. It should always include the following information:

- Contact information of the client and the subcontractor

- VAT registration number of both of them if VAT applies in their country and if they are VAT registered

- Financial data of the subcontractor

- Credit note number

- Issue date

- Amount to be credited

- VAT percentage applicable

- Grand total of the credit note, VAT included

3. What other information might be added to a credit note?

The due date and the client’s financial details are actually optional, but they can obviously be included.

The identification number of the related invoice(s) as well as the reason(s) for generating this document can also be mentioned.

Depending on the client or the subcontractor, other information could be added, such as the name and number of the translation project(s) to be credited, the project manager’s name, the requester’s details and so on.

In all cases, the “CREDIT NOTE” terms should clearly state the nature of this legal document, so that it cannot be confused with a new invoice.

4. Reasons to issue a credit note

a. Translation quality problems

Sometimes clients require a credit note when they are not happy with the quality of a translated text. Before agreeing to issue such a document, the translator or the translation agency should receive accurate feedback or take a very close look at the final target text sent back by the client to assess the scale of the problem.

Judging the quality level of a translation is often subjective. Therefore, before acknowledging a quality problem, you should make sure that unquestionable mistakes are present, such as typos or failures to comply with glossaries, style guides or any instructions provided by the client.

After some discussion, the client will hopefully drop the credit note request or at least agree to decrease the required amount to be credited, for instance from 50% of the job budget to 15%.

b. Other project problems reported by the client

Credit notes might also relate to complaints linked to production tasks other than pure translation, for example the desktop publishing of some target files, the testing and debugging of the localised software, the rebuilding of Flash animations or even the creation of a multilingual website. If the client estimates that the final result is not worth the amount initially quoted or invoiced, he might insist on getting a credit note for a specific value.

Some dissatisfaction could also relate to project management tasks, for instance failing to deliver a translation project on time. Missing a specific deadline could be highly detrimental to a client, who will demand compensation from the provider.

c. Mistakes in some compulsory data

If some key data on the invoice are not correct, such as the company address or VAT number, the client will ask the subcontractor to issue a credit note stating the same “wrong” data and to create a brand new invoice showing the correct information. Imagine a Translation Project Manager (TPM) providing localisation services to a client contact based in a subsidiary of an international company and addressing his invoice to this local office. When the client’s accountant starts paying the invoices, he suddenly realises that this specific invoice was meant for head office. He will consequently require a credit note to cancel the first invoice in his accounts. Similar cases could also occur due to company mergers.

Regarding other erroneous data that could appear on an invoice, some clients will demand a credit note while others will simply change the data themselves or even register the invoice containing the mistake. The final amount stated on the invoice might not exactly match the price the client was expecting, but he pays it anyway, especially when it is lower than planned :-).

d. Non-compulsory information errors

The internal policy of some companies, whether they are end-clients or translation agencies, dictates certain guidelines for the content of the invoices to be received. Failing to follow them could lead to a request for a credit note.

Let’s imagine you work for three project managers (PM) within the same translation agency and, at the end of the month, you issue one single invoice including all your jobs. Depending of their internal approval policy, some agencies prefer to receive one invoice per PM. In this case, you would have to send a credit note cancelling the first invoice and reissue three new invoices, each listing the work delivered to the different PMs.

Similarly, many clients use Purchase Order (PO) numbers for translation jobs. Forgetting to include those numbers or referencing the wrong ones on invoices might prompt them to ask for a credit note.

A subcontractor might also mistakenly invoice one job twice. If he included several translation jobs on his invoice, the client will either require a credit note only for the amount of the duplicate job, or opt for a credit note covering the whole invoice and ask the subcontractor to reissue the complete correct invoice.

Example of a credit note for a translation project

5. When to issue a credit note

You need to create a credit note when you have sent an invoice to the client that can no longer be changed. If the invoice has not yet been registered in the client’s and subcontractor’s accounts, it will still be possible to amend it without having to create a credit note. However, once the invoice is formerly registered in any of the parties’ accounts, the only official method of cancelling it (or part of it) is to issue a credit note.

Another way of avoiding a credit note is to credit the amount in question on the next invoice. In this case, the subcontractor submits an invoice for the new jobs delivered and adds a line with a negative amount, which is the amount to be credited to the client. Obviously, this procedure will not apply when the problem concerns incorrect official information on invoices.

Occasionally, clients will request a credit note even if the subcontractor has not sent his invoice yet. This could happen when a client is checking a translation and considers that the level is not up to the quotation amount agreed upon beforehand. In this case, if the translator or the translation company accepts the quality problem, they will not need to actually generate a credit note as they will simply reduce the amount of the next invoice.

6. How to settle credit notes

There are two ways to credit clients the amounts due:

- You pay the client the amount specified on the credit note.

- The client deducts the credit note amount from his next payment.

Let’s suppose that after sending several invoices for a total amount of 4,000 euros, you issue a credit note of 600 euros. The client will only pay 3,400 euros on the due date. This exempts you from a payment, but forces you to perform some extra calculations.

7. How to avoid having to issue credit notes

When they are linked to quality problems reported by the client, this is not always easy. Ensuring you conform to all the clients’ requirements and don’t make any indisputable mistakes is obviously a must. Still, some clients might continue to ask for credit notes simply arguing that they do not like your translation style. In this case, it is probably preferable to stop working for them.

It goes without saying that you should double-check which official information needs to appear on the invoices. However, sometimes, the requester might not even know himself and provide you with the wrong information.

If possible, when the data that needs amending is the name of a contact person or a PO number on an invoice, find out from the client whether it is really necessary to issue a credit note and a new invoice. Sometimes clients might agree to correct such data internally to avoid extra paperwork.

Provided the compulsory legal information is present, you can normally prepare your invoices the way you want. Most subcontractors do not like to be told how to format them. On the other hand, many clients have specific rules and preferences and might block or delay the payment of some invoices by arguing that you failed to comply with their internal accounting policy. It might, therefore, be preferable to adhere to their guidelines to receive payment as soon as possible.

Unfortunately, in most cases, registering credit notes and potential new invoices will indeed delay the payment process, as issuing credit notes is time-consuming. First, you have to find out why they are required and discuss this with your client. You then have to create the credit notes, submit new invoices and record both. Next, you have to pay them or track the payment of the reduced invoices. Finally, your accountant has to enter all this extra data in the financial system and monitor the accuracy of the final account.

All this costs money. Not only for the subcontractor, but also the client. That’s why clients and translation agencies should, ideally, refrain from asking for credit notes unless they are an absolute necessity, and they should definitely remain an exception rather than the norm.

Nancy Matis, March 2015

Read more articles on Carol's blog

Comment

Thanks for the mention!

By Caroline Alberoni (not verified) on Friday, 10/26/2018- Permalink

:-)

By Nancy Matis on Friday, 10/26/2018- Permalink

In reply to Thanks for the mention! by Caroline Alberoni (not verified)

You're welcome, Caroline! :-)

Ajouter un commentaire | Drupal

By Mia (not verified) on Thursday, 10/17/2024- Permalink

In reply to :-) by Nancy Matis

With thanks, Valuable information.

Best Essay writing

People express case study

Thanks a lot for giving credit to my blog and for suggesting people to read it, Nancy!

Much appreciated. :)